Europe’s Electric Vehicle Dilemma: Balancing Sunk Costs and Strategic Shifts

Introduction

Europe stands at a pivotal crossroads in its transition to electric vehicles (EVs). With climate commitments on one side and market uncertainties on the other, the region faces a difficult choice: proceed with aggressive fossil fuel bans or reconsider the pace of electrification. Recent reports highlight the consequences of either decision, from massive economic losses to transformative industrial opportunities.

EV Sales Decline and Policy Headwinds

Electric vehicle sales across the European Union declined by 5.9% in 2024, according to the European Automobile Manufacturers Association (ACEA). This drop, combined with external threats such as new tariffs from the United States, has raised concerns about the region's ability to meet its 2035 ban on internal combustion engine (ICE) vehicle sales. Persistent market sluggishness has cast doubt over the timeline for fully phasing out fossil-fueled cars.

High Stakes: What If the 2035 Ban Fails?

Abandoning the 2035 ICE ban could lead to the loss of 1 million jobs across Europe and render much of the investment in zero-emission infrastructure and technology obsolete. Up to two-thirds of investments in EV-related sectors such as battery production could be lost. Despite pressure to relax carbon reduction goals, the EU continues to uphold the ban as part of its Green Deal agenda.

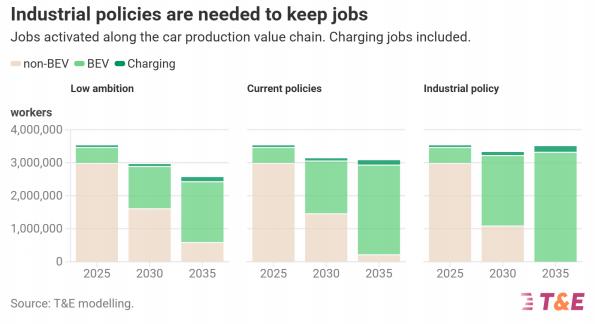

Job Creation and Value Chain Transformation

A recent report emphasizes that if the EU maintains its 2035 target and supports emerging green industries, the auto sector’s economic contribution could rise by 11%. Over 120,000 new jobs could be created by 2035, largely in battery production and electric powertrains. Europe’s ability to generate over 900 GWh of battery production capacity is key to realizing these employment gains. The battery value chain alone could grow fivefold, contributing nearly €79 billion.

Risk Analysis of EV Manufacturing Projects

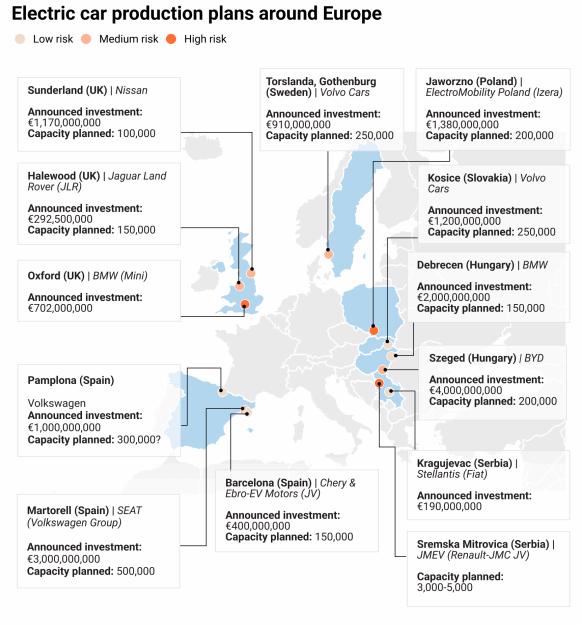

Thirteen new EV manufacturing projects across Europe have been analyzed based on their development stage, construction progress, site certainty, and government support. These projects are divided into low, medium, and high-risk categories:

- Low-risk projects include BMW's Hungary plant and Volvo's Slovakia factory, which are entirely new facilities. Others like Stellantis' Serbia site and the Volkswagen-Chery collaboration in Spain involve repurposing existing ICE lines. Combined, these projects represent 550,000 vehicles in annual capacity and 4,800 jobs supported by €4.8 billion in investments.

- Medium-risk projects include BYD’s Szeged plant in Hungary (€4 billion) and major retrofitting efforts at SEAT-Volkswagen’s Spanish facility and Jaguar-Nissan sites in the UK. Together, these projects aim to deliver 1.2 million EVs annually and create over 11,000 jobs.

- High-risk projects are still in the early stages or awaiting final investment decisions. These include BMW's postponed MINI factory in Oxford and a Renault-JMC joint venture in Serbia.

If completed, all 13 projects could add 2.1 million EVs in annual production by 2027, significantly boosting capacity from 2024’s 1.8 million.

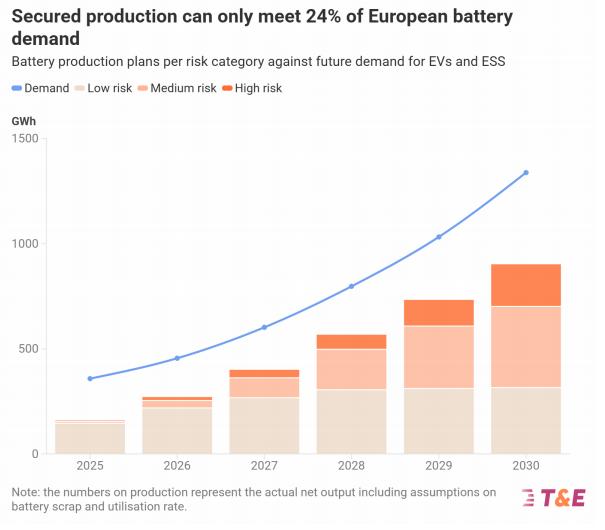

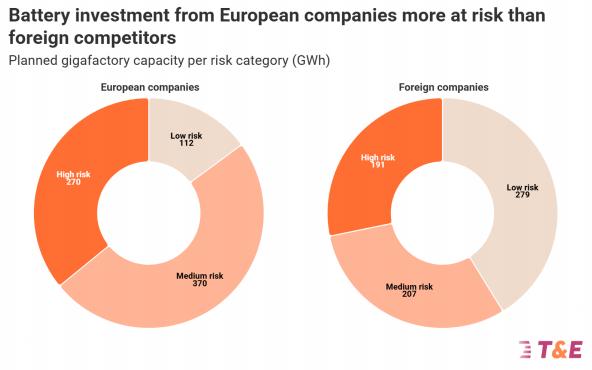

Battery Sector: Investment and Uncertainty

The battery sector, central to the EV ecosystem, has seen heavy investment but also mounting risk. Despite €36 billion already allocated, 12 out of 16 battery factories in Europe face delays or cancellations. Northvolt, once a flagship initiative, filed for bankruptcy after exhausting over €14 billion.

T&E's analysis of European battery plants classifies them as:

- Low-risk: Projects like ACC in France and Volkswagen’s PowerCo in Germany are already operational or under construction, offering 391 GWh in capacity, 43,000 jobs, and backed by €39 billion in funding.

- Medium-risk: Representing the largest share of planned capacity (627 GWh), these projects await final investment decisions and include emerging technologies like solid-state batteries. The Basquevolt project in Spain is a key example.

- High-risk: Still in concept or permitting phases, these projects account for 410 GWh in capacity and €21 billion in investments, with 37,000 associated jobs at stake.

Depending on how many projects succeed, Europe could meet only 24% to 66% of its battery needs by 2030. If only low-risk projects proceed, the EU's 40% battery self-sufficiency goal would be missed.

National Variances and Future Outlook

Spain has ambitious goals of reaching 244 GWh in battery capacity by 2030 but only 13% of this comes from low-risk projects. In contrast, Hungary and Poland show stronger progress with low-risk capacities of 125 GWh and 115 GWh, respectively.

France and Germany, the traditional automotive leaders, stand at an intermediate stage with over 350 GWh combined capacity. However, only 130 GWh is currently categorized as low-risk.

Conclusion: Navigating an Uncertain Road Ahead

Europe's EV strategy is at a critical inflection point. Policymakers must strike a delicate balance between long-term sustainability goals and short-term industrial realities. The sunk costs already invested in EV and battery manufacturing are substantial, and any rollback in green policies could result in significant economic and employment losses.

To succeed, Europe needs coherent industrial policy, infrastructure investments, and continued regulatory commitment. The cost of inaction or policy reversals may be too high for the continent’s green future.

Categories: vehicles